As we move into the last quarter of the year and fast approach the end of 2023, we reflect on the past month in our October Investment Summary.

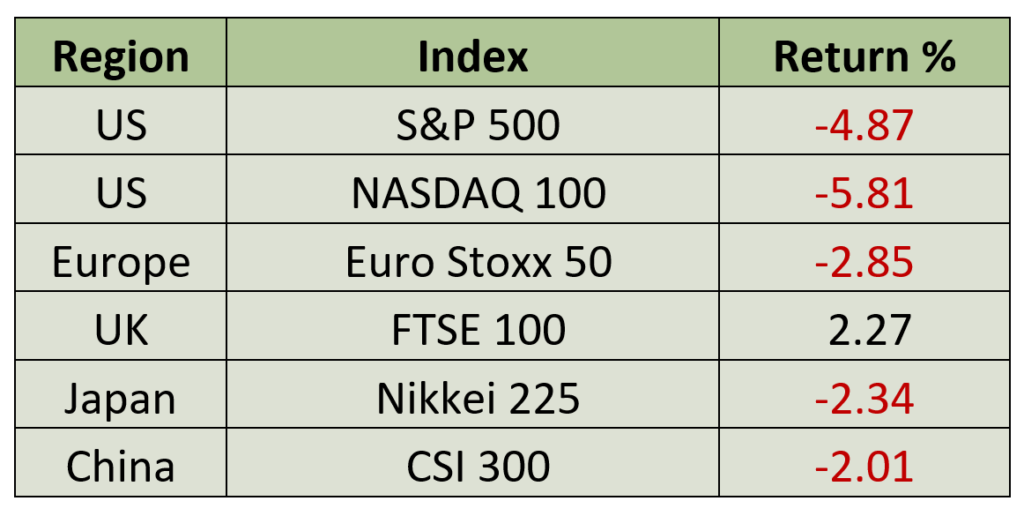

Despite only one major central bank raising interest rates in September, last month proved to be the worst of the year for both equity markets and fixed income. The three major central banks (the US Federal Reserve (Fed), Bank of England (BoE), and the European Central Bank (ECB) indicated their intention to embark on an extended pause in the hiking of interest rates. Rather than soothing markets, the mere mention of a pause had the opposite impact, leading to a surge in long-term yields. Across most developed world bond markets, yields on longer maturities climbed by 30 – 50 basis points during the month. At the time of writing, these trends are continuing.

Source: Bloomberg

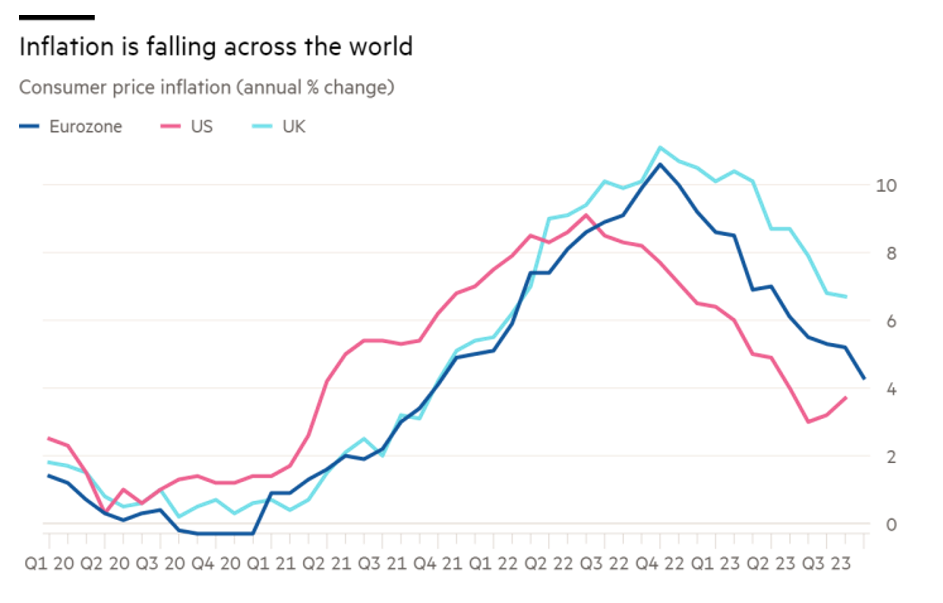

Progress in reducing inflation continues, as the most recent data showing headline inflation in the US, Eurozone, and the UK, now standing at 3.7%, 4.3% and 6.7% respectively, a significant drop from the highs of last summer. The central banks expressed satisfaction with these developments and all suggested that policy might be sufficiently tight to bring inflation back to their 2% targets, provided that interest rates remained at restrictive levels for an extended period. In other words, interest rate cuts are not on the horizon any time soon.

Source: Eurostat, Office for National Statistics, Bureau of Labour Statistics

Market expectations have consistently centred around the expectation of a gradual decline in interest rates next year. However, the realisation that interest rates will not be declining as swiftly as hoped, prompted the markets to re-evaluate their valuations of equities and longer dated bonds. In addition, US economic data is not signalling the much feared and forecasted recession, nor does it indicate a significant slowdown in growth to ensure a return to the target rate of inflation. Consequently, concerns persist that the Fed might find it necessary to further raise interest rates, casting doubt on the attainment of the highly sought-after but elusive “soft landing”.

The shift in sentiment had a detrimental impact on overvalued equities and similarly affected longer dated fixed income securities. For instance, an investor holding a 20-year maturing US treasury bond has seen their principal erode by more than 15% since the end of March.

Source: LSEG – Financial Markets Infrastructure and Data

There might be a more significant underlying issue at play. We have frequently highlighted the size of fiscal deficits in much of the developed world and the risks these deficits pose when trying to finance them in a higher interest rate environment. Even in the face of positive economic growth, many countries are running budget deficits of a size generally associated with recessions, with the United States being the major culprit. The current fiscal year’s budget deficit in the US stands at nearly 7% of GDP, a concerning figure that’s beginning to catch the market’s attention.

The cost of servicing the over $30 trillion in outstanding government debt is rising rapidly and is on track to become the single largest individual component of government spending. This trajectory is unsustainable. There is little prospect of the US reducing spending or raising taxes to cover this excess spending, especially just ahead of the 2024 presidential election.

To compound matters further, the US government narrowly avoided a shutdown, triggered by internal strife within the Republican party and the resultant failure to pass spending bills. While a 45-day spending extension was agreed, it came at the cost of the House of Representatives’ Republican leader losing his role, with no obvious replacement. The House is effectively incapacitated until a replacement is determined, and there is no reason to believe this process will be swift or straightforward.

The issue of mounting debt is not exclusive to the US. Recall that just over a year ago, in the UK, yields on long-term gilts surged when the markets reacted negatively to a proposed tax cut and a substantial increase in the UK deficit. Italy too, has recently experienced a rise in yields after the Italian government proposed ambitious spending plans, which would lead to an increase in their budget deficit from 4.5% of GDP to 5.3%. Even Japan has witnessed a rise of around 40 basis points in long-term interest rates this year, despite spending billions of dollars a month in an attempt to put a cap on yields.

There is no straightforward solution for a fiscally irresponsible government in this situation. Voters are generally happy to have government money spent on them but dislike the taxes required to fund the spending. The era of zero interest rate policies (ZIRP) and quantitative easing that existed before the pandemic, allowed governments to run larger and larger deficits with little financial consequence. It is not clear if they realise how the environment has changed.

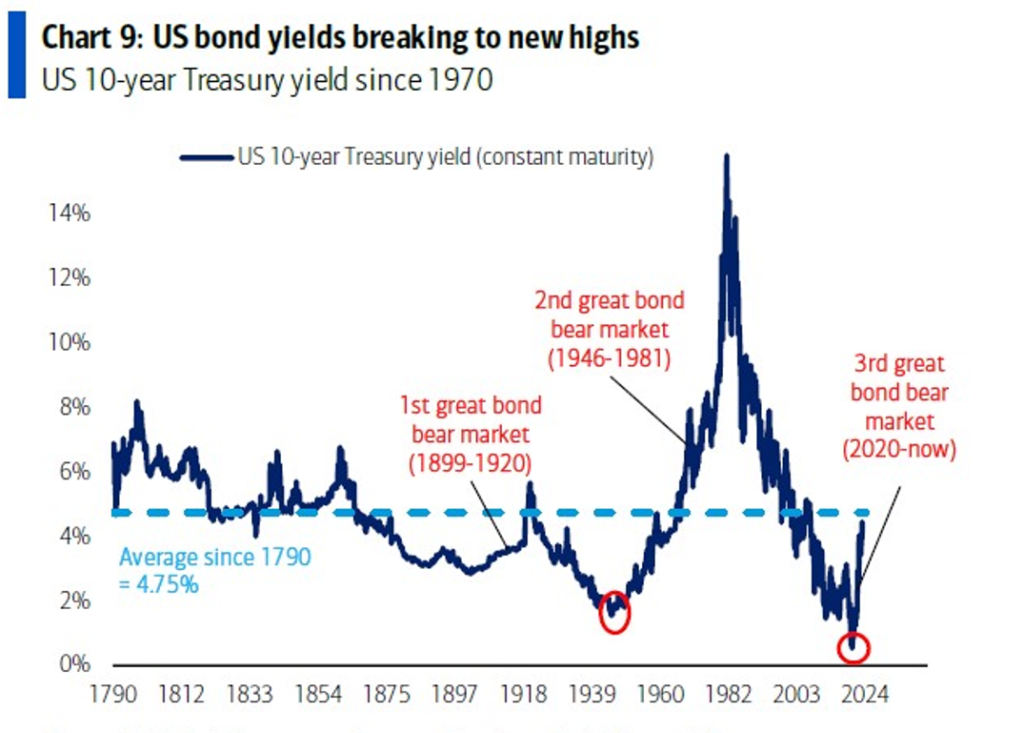

When a government cannot increase taxes and refuses to cut spending, what options remain? Default is not a viable option for a developed nation, so you are left with inflating away the debt as your best option. Higher inflation can boost nominal GDP and tax receipts while eroding the real value of your long-term liabilities. This might be the direction in which the world is headed – higher inflation and interest rates compared to what we’re accustomed to. Some even suggest the onset of a bear market for bonds.

Source: BofA Global Investment Strategy, Bloomberg, Global Financial Data – BofA Global Research

Navigating the shift to this new economic landscape presents challenges. Many asset prices are still in the process of adapting, and volatility is expected to remain elevated, potentially revealing that many price-to-earnings multiples are too high. The recent move in yields could even trigger the long-anticipated recession in the developed world. However, it’s not all doom and gloom. The ongoing adjustment in asset prices will create opportunities. Many companies have pricing power and will be able to operate comfortably in an environment of higher inflation. Patience and a readiness to endure turbulent markets will be essential.

We remain cautious and conservative in our positioning. We are not chasing the runaway expansion of price-to-earnings ratios in the technology sector. Owning stocks with excessively high valuations leaves little room for error if those valuations suddenly shift. Furthermore, we maintain a moderate fixed income duration, as we do not anticipate rate cuts coming and foresee expected concerns about fiscal deficits putting upward pressure on yields.

Nevertheless, we do want to retain some duration, as a sharper economic slowdown triggered by these elevated interest rates could lead to a brief bond rally. We expect the remainder of the year will be characterised by increased volatility and may not be as rewarding as the first half, but we have confidence that our strategic positioning will enable us to navigate through these challenges.

Discover more informative content from our Chief Investment Officer Jeff Brummette in the recent Investment Summary for September 2023 and our insightful half-way point 2023 Mid-Year Outlook. Stay tuned for more insights from Oakglen on the hot topics and latest trends in the financial markets. You can also sign up to our mailing list for more regular communications using the section below or get in touch with one of the team.