Remarkably, we find ourselves halfway through the year witnessing impressive performances in some of the major equity markets. With both global economies and markets showcasing their resilience so far, now is a good time to consider the potential investment opportunities and upcoming risks in our Mid-Year 2023 Outlook.

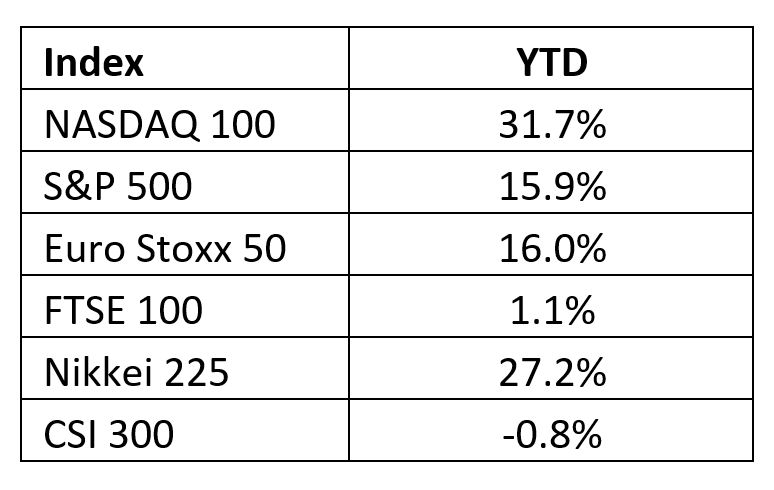

Global equities (measured by the MSCI All-Country World Index) finished up 14% (in USD terms). It was developed markets that led the way, notably the US which benefitted from its exposure towards the technology sector which was buoyed by enthusiasm around artificial intelligence (AI). The technology-heavy NASDAQ 100 subsequently surged more than 30%, the S&P 500 has risen by 15%, most European markets have gained over 10%, and Japan is up 23%, (with the FTSE 100 and Chinese markets being the exceptions, remaining relatively flat thus far).

This all occurred despite major central banks continuing to raise rates. So far this year, the US Federal Reserve (Fed) has only raised rates a mere 75 basis points, while both the Bank of England and European Central Bank have hiked rates by 150 basis points.

The equity rally commenced in March just as the markets panicked about banking failures in the US. Responding swiftly, the Fed established new borrowing and liquidity facilities for banks. As a result, interest rates dropped, and their expectation for future rate hikes diminished. The liquidity injection, followed by Nvidia’s very optimistic earnings predictions based on the AI driven need for their chips, sparked a dramatic rally in technology stocks.

Source: Bloomberg

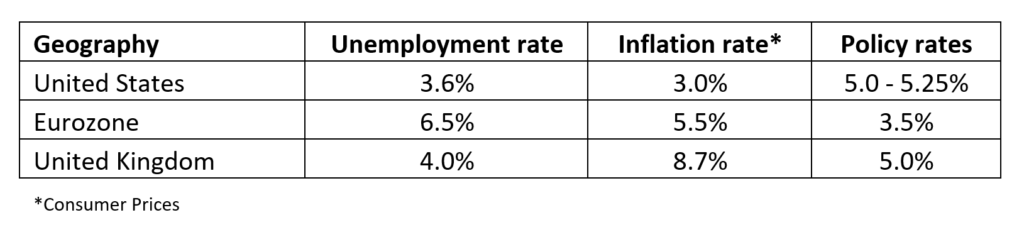

The increase in interest rate hikes has been employed to curb inflation, which has significantly decreased from its peak last summer but still surpasses the 2% target set by central banks. The drop in headline inflation can be attributed largely to the decline in energy prices, yet underlying services inflation remains stubbornly persistent. The objective of raising interest rates to combat inflation is to hinder economic activity by making it more expensive for businesses and households to borrow money. However, despite the size of the rate hikes implemented since the beginning of last year, the expected slowdown in economic activity has not materialised. Unemployment rates remain exceptionally low, with only the manufacturing Purchasing Managers’ Index surveys indicating a potential deceleration, while service sector surveys continue to show expansion. The narrative from central banks is very much to maintain a hawkish stance whilst suggesting prolonged periods of higher interest rates.

Source: Bloomberg – 12.07.2023

There are those who would argue that central banks have already done too much. In addition to interest rate hikes, they are also reducing their balance sheets through maturities and the sale of their securities holdings, a process known as quantitative tightening rather than quantitative easing. It is widely believed that the effects of monetary policy on economic activity are delayed, typically taking 12 to 18 months to manifest. Therefore, it is possible that we have yet to witness the full impact of the central banks’ actions.

The challenge lies in the uncertainty surrounding the question of when the effects will materialise, as neither we, nor the central banks, possess definitive answers to that question. Considering their initial slow response to the inflation threat, it appears that the central banks will continue tightening monetary policy until they observe more evident indications of a slowdown in economic activity and a further decrease in inflation.

Historical evidence demonstrates that inflation tends to recede when the policy rate surpasses the inflation rate. While the Fed has achieved this with respect to headline inflation and is nearing that point for core inflation, the BoE and the ECB have more to do. Moreover, it is probable that interest rates will need to remain above inflation for some time to ensure the long-term return of inflation to the targeted 2% rate.

Source: Bloomberg

Considering the aforementioned factors, what can be anticipated from the economy and markets?

If we assume that central banks remain committed to their objectives of achieving a 2% inflation target, we should, at the very least, expect interest rates to move above current levels and remain elevated for some time. This, in turn, could lead to an increase in unemployment rates, a deceleration in economic growth, and a decline in inflation. Additionally, there is the possibility of a recession. It is probable that corporate earnings will face downward pressure as well. However, the severity of these outcomes is inherently unpredictable.

Governments have expressed their support for the actions of central banks and their commitment to combat inflation. However, if unemployment was to rise rapidly and economic growth were to sharply decline, governments might adopt a different stance towards their central bankers. Pressured by their political leaders and potentially influenced by public sentiment, central bankers could potentially ease their efforts in fighting inflation and declare success if inflation levels approach around 3%. Whilst it is too premature to make such a prediction, it is an outcome that warrants consideration.

In terms of equity markets, our assessment indicates that the significant surge witnessed in US technology stocks is unlikely to be replicated in the second half of the year. Valuations in this sector are very rich, leaving investors with very little protection should sentiment quickly shift. We find greater comfort in equity markets that are reasonably valued, such as Europe and the UK. These markets also tend to offer higher dividends, which can serve as a cushion in a slower growth environment. Additionally, maintaining cash reserves and quality fixed income investments are also valuable components of a portfolio. Fixed income yields are high enough that the asset class can now provide both a return and protection in slower growth environment. However, we remain cautious regarding lower credit securities as believe they do not provide a significant yield advantage over government bonds at present. This perspective should change as growth decelerates.

We held optimistic expectations of encountering potential investment opportunities in China following the lifting of the Covid-19 lockdown, but that hasn’t proved the case. There is now an increasing likelihood that Chinese authorities are planning some more stimulus measures. We firmly believe that if the Chinese government implements an intensified stimulus plan, the domestic market should present some interesting investment opportunities. This positive view is reinforced by the current low valuations for domestic Chinese equities compared to historical levels.

We have been lucky so far to experience a moderation in inflation without a substantial decline in growth or a notable increase in unemployment. There is a possibility that our luck will persist, and we might even witness the realisation of the Fed’s “soft landing scenario”. However, relying on luck is not a prudent strategy, and therefore, we prefer to adopt a conversative approach to our portfolio allocation.

Read more from our Chief Investment Officer Jeff Brummette in our Investment Summary for July 2023 and compare how things stack up from last month. Stay tuned for more insights from Oakglen on the hot topics and latest trends in the financial markets. You can also sign up to our mailing list for more regular communications using the section below.